Introduction:

In an interconnected global economy, understanding the role of asset classes is essential for wealth creation and financial well-being. This blog explores how asset classes contribute to both local and global economies, focusing on their importance in wealth creation for the common man. We’ll also discuss the types of assets available for investment and how individuals can benefit from them.

Fixed Deposit Return

A fixed deposit is a type of savings account offered by banks where individuals deposit a sum of money for a fixed period, typically ranging from a few months to several years, at a predetermined interest rate. In return, the bank pays interest on the deposited amount, which is usually higher than that of a regular savings account.

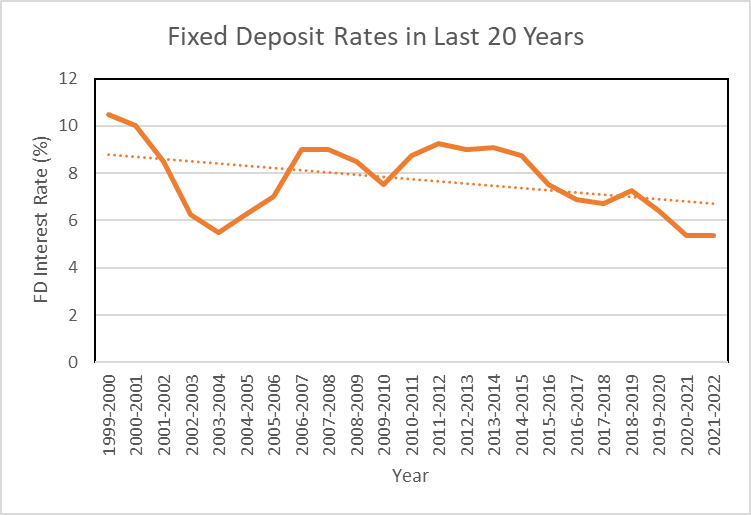

In the nation, risk-averse assets like fixed deposits are preferred due to the lack of disposable money. In India, fixed deposits continue to be among the most dependable and well-liked investing choices. You might find it hard to believe that bank fixed deposit interest rates ever reached 13% if you research the history of rates in India.

Additionally, the rates had drastically decreased from 9.50%–10.00% in 2000–01 to a historical low of 5.75% in 2003–04.

Gold Return

Introduction

While there are many different kinds of precious metals, gold is highly valued as an investment. Gold is one of the most favored investment options in India because of a number of influencing variables, including its high liquidity and ability to overcome inflation.

Gold investment can be done in many forms like buying jewelry, coins, bars, gold exchange-traded funds, Gold funds, sovereign gold bond schemes, etc.

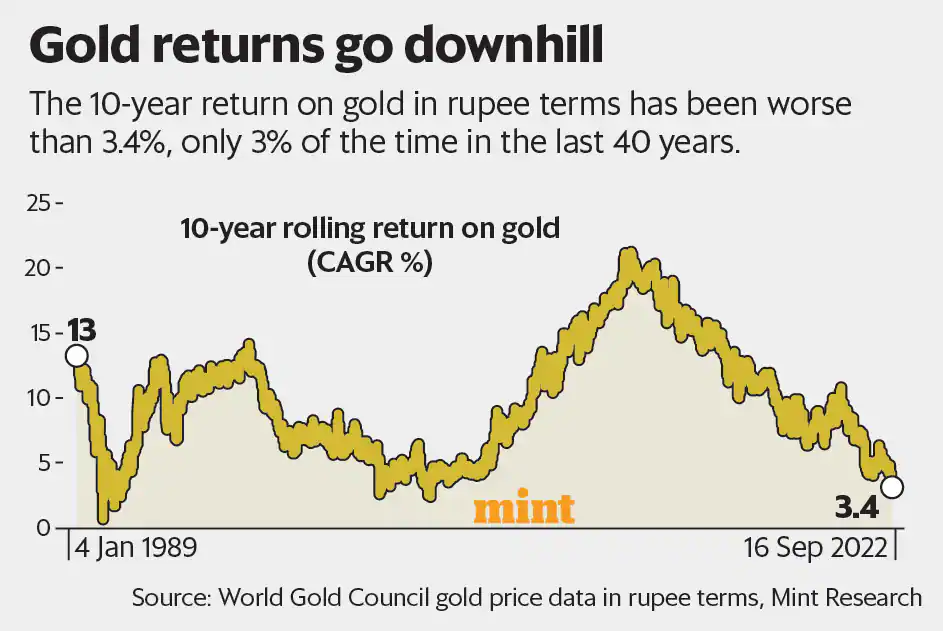

Goldhas had a challenging ten years. Gold investors have not even been able to outperform inflation over the 10 years ending August 16th, with a return of just 3.4% in rupee terms. This is really uncommon for the pricey metal. Based on World Gold Council price statistics, a Mint examination of 10-year rolling returns for gold reveals that, when looking at data from 1979 to 1989, it has only produced a 10-year return that is less than 3.4% CAGR 3% of the time.

These findings underscore the dynamic nature of gold as an investment asset and the importance of considering broader economic and market factors in evaluating its performance. While gold may not consistently deliver high returns over short-term periods, its role as a diversification tool and store of value remains relevant in the context of long-term portfolio management and risk mitigation strategies.

Real Estate Return

The real estate sector is one of the most globally recognized sectors. It comprises four sub-sectors – housing, retail, hospitality, and commercial. The growth of this sector is well complemented by the growth in the corporate environment and the demand for office space as well as urban and semi-urban accommodation. The construction industry ranks third among the 14 major sectors in terms of direct, indirect and induced effects in all sectors of the economy.

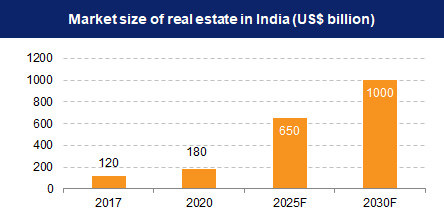

Even while buying property is still highly common in India, real estate returns have only been CAGR 9% CAGR over the past 20 years, CAGR 6.5% CAGR over the past 15 years, and CAGR 4.8% CAGR over the past 10 years. The annual return on real estate, CAGR at 6%, has been less than half of what investors have made from Indian shares. The real estate returns over the last three and five years have been a meagre CAGR 4.8% and CAGR 5.2%, respectively.

By 2040, the real estate market will grow to Rs. 65,000 crore (US$ 9.30 billion) from Rs. 12,000 crore (US$ 1.72 billion) in 2019. Real estate sector in India is expected to reach US$ 1 trillion in market size by 2030, up from US$ 200 billion in 2021 and contribute 13% to the country’s GDP by 2025. Retail, hospitality, and commercial real estate are also growing significantly, providing the much-needed infrastructure for India’s growing needs.

Debt Returns

The financial gains made by investors in debt instruments, such as bonds, CDs, treasury bills, and other fixed-income assets, are referred to as debt returns.

- Debt investments involve lending money to a company, government, or financial institution in exchange for regular interest payments and the return of the principal amount at maturity.

- This is in contrast to equity investments, which allow investors to become partial owners of a business and share in its profits through dividends and capital appreciation.

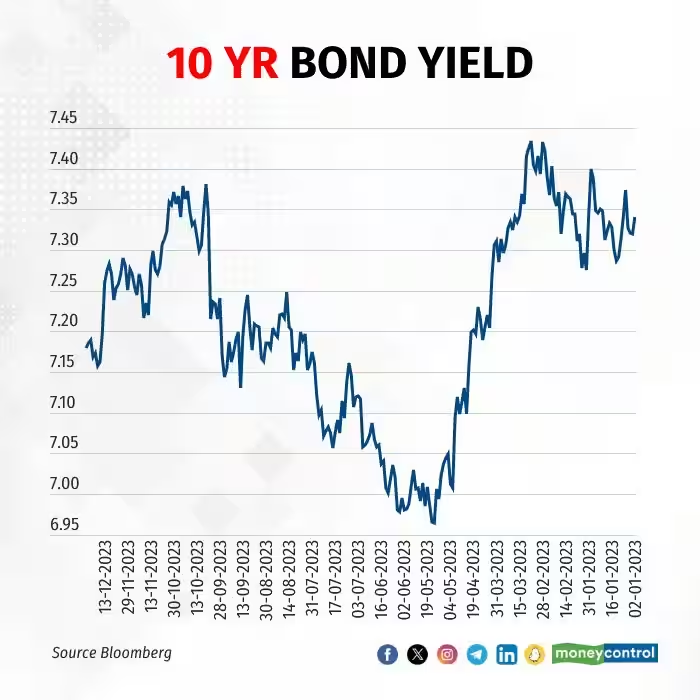

- In 20 years, debt investments have yielded a CAGR 7.2% return, and in 15 years, a CAGR 7.5% return. The average debt return in a year has been CAGR 6.5%. The returns on debt investments have been CAGR 5.5% and CAGR 6.8% in the last three and five years, respectively.

- The expected range for the 10-year benchmark government bond is CAGR 6.70-7.30 percent.

Yield movement in 2023

At the start of the calendar year 2023, the yield on Indian bonds, especially 10-year benchmark bonds, was higher in the range of CAGR 7.00-7.44 percent due to higher inflation and rate hikes by the Reserve Bank of India (RBI), experts said.

Stock Market Return

The stock market, also referred to as the share market or the equity market, is a centralised exchange where buyers and sellers exchange publicly traded company shares. It acts as a marketplace where businesses can raise money by selling investors stocks, and where investors can purchase and sell those stocks.

About the Nifty 50 index

- A diversified 50-stock index that represents important economic sectors is called the NIFTY 50.

- Based on free-float market capitalization, this index monitors the performance of the 50 major blue chip businesses that are quoted on the NSE.

- Together, these equities represent more than two-thirds of the free-float market capitalization of all traded securities on Indian exchanges, making them the most liquid securities as well.

- results for the Nifty 50 index like many of the leading global indices, the Nifty 50 is based on market capitalization. This indicates that the index now consists entirely of the highest-cap stocks. Individuals who score lower than 50 are removed from the index, while those who score higher are included. Each stock is assigned a weight determined by the size of its free-float market capitalization.

20-year Investment Return Calculation:

With 17% returns over 20 years, Indian equities have outperformed all other asset classes, including debt, US equities, gold, and real estate.

Examples: Just 20 years ago, you could have invested Rs 1 lakh in Indian stocks, which may have increased to almost Rs 24 lakh by now. But in 20 years, the identical investment in real estate and gold could have only been worth about Rs 5.6 lakh and Rs 9.6 lakh, respectively. Based on the 20-year returns from various asset classes, a computation based on the value of Rs 1 lakh invested in US equities may have been just about Rs 11.3 lakh.

As per Funds India’s recent “Wealth Conversation Report,” Indian equities have yielded 17% returns in 20 years, outperforming all other asset classes such as gold, real estate, US stocks, and debt.

Indian stocks (Nifty 50 TRI) have returned 17.2% over the last 20 years, 10.6% over the last 15 years, and 13.3% over the last 10 years, according to the research. Indian stocks have returned 12.9% and 26.1% over the last three and five years, respectively.

INDEX | No of times your money multiplied -as of 31- Jan – 2024L | |||||

3Y | 5Y | 1OY | 15Y | 20Y | ||

India- Equity ( Nifty 50 TRI) | 1.2X | 1.7x | 2.1x | 4.0x | 9.0x | 15.5x |

US- Equity (S&P TRI IN INR ) | 1.3x | 1.6x | 2.3x | 4.4x | 13.6x | 11.9x |

Gold (in INR) | 1.1x | 1.3x | 1.8x | 2.2x | 3.8x | 9.4x |

Real Estate | 1.0x | 1.2x | 1.3x | 1.5x | 2.6x | 4.9x |

Debt | 1.1x | 1.2x | 1.4x | 2.0x | 2.9x | 4.0x |

Source: Funds India Wealth Conversation Report Jan 2024 .

Conclusion

In conclusion, given the wide variety of methods available, it is essential for stock market participants to have a well-thought-out plan of action. Moreover, people may be able to make large gains from stock market trading online without having to pay the overhead expenses of common businesses. To differentiate the stock market from gambling, one must adopt a business attitude and concentrate on making smart decisions rather than depending only on chance or luck.

Overviews

The Stock market consistently outperforms other asset classes such as gold, fixed deposits, and debt instruments due to their potential for higher returns and capital appreciation over time, making them a preferred choice for investors seeking strong long-term growth opportunities. However, investors should be conscious when investing in the stock market, and it’s advisable to conclude their financial advice by consulting with professionals regarding any stock market-related investment.